Gold bars, with their rich history as a monetary exchange asset spanning thousands of years, are a popular and attractive investment option. Their compact size and affordability offer investors several advantages, from lower premiums to anti-counterfeit measures, with a tradition of wealth preservation.

Gold bars gained traction as a monetary asset in the 9th century and remain valued as intrinsic assets, a secure hedge against inflation, and a long-term store of wealth. 1-oz .9999 fine (pure) gold bars have become increasingly popular since the 2008 Financial Crisis, offering investors a popular tangible asset with stability and liquidity for portfolio diversification and wealth protection against market volatility.

1-oz gold bars, often referred to as ‘cheaper gold,’ offer a more cost-effective investment option compared to gold bullion coins, with lower premiums. In fact, they can cost as much as $25 per ounce less than the best-selling 1-oz American Gold Eagle or South African Krugerrand coin, making them a more affordable choice for investors.

1-oz gold bars are compact and packaged to stack conveniently for long-term storage. As gold prices continue to rise compared to the devaluing dollar, they offer a practical and organized way to store vast wealth and protection against inflation.

Buying 1-oz gold bars is straightforward when you partner with a reputable dealer, providing peace of mind and confidence in your investment. Investors have a variety of reputable refineries and mints to choose from, such as PAMP Fortuna, Valcambi, and Credit Suisse.

Because 1-oz gold bars are .9999 fine, most are eligible for IRAs, including 1-oz bullion bars, 100-gram, 10-ounce, and kilo gold bullion bars. Gold and silver IRA accounts hold physical bullion products as a retirement investment backed by the wealth preservation power of precious metals. For more information about IRAs, refer to Putting Gold and Silver in an IRA

Investors have a variety of reputable brands to choose from, including those that offer beautiful designs, hallmarks of authenticity, and renowned quality assurance.

Perth Mint 1-ounce gold bars are widely available and are among the two most popular 1-ounce gold bars sold in the United States, the other being PAMP 1-ounce gold bars. Each Perth Mint bar is individually packaged in containers of 25 bars.

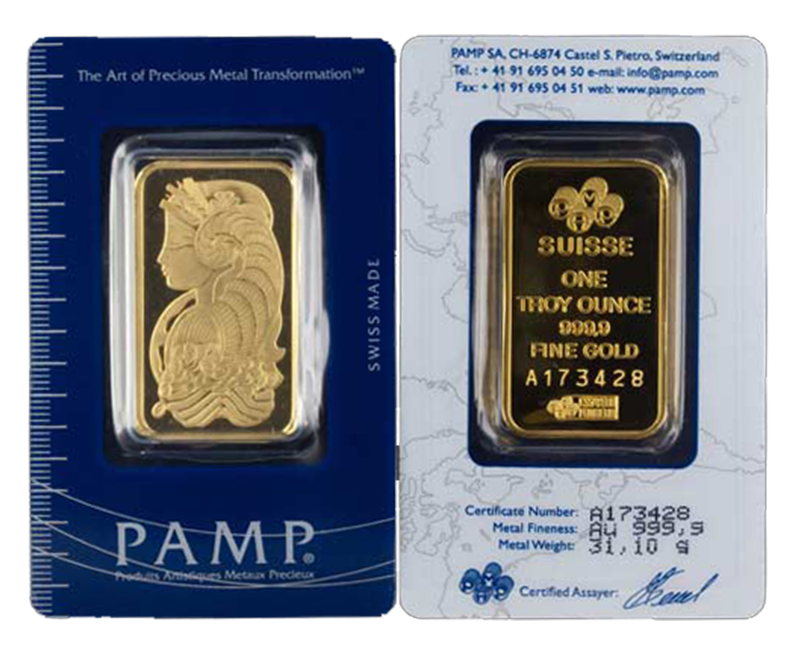

PAMP, known for their impeccable designs and high-quality standards, used to dominate the one-ounce gold bar market, is a competitor with Perth Mint 1-oz gold bars. PAMP and Perth Mint gold bars are .9 99 fine (99.99% pure) and sold in cases of twenty-five bars. Each bar is encased in Mylar and includes a certificate of authenticity.

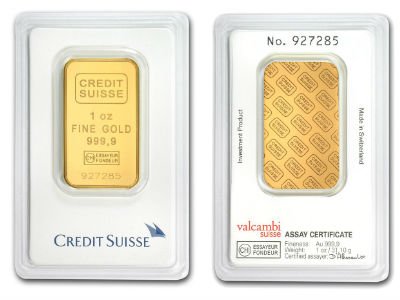

Credit Suisse 1-ounce gold bars are available for purchase but are typically sold in larger quantities than Perth Mint bars. Credit Suisse and PAMP manufacture similar gold bars; however, their designs differ. Credit Suisse bars feature the Credi Suisse hallmark, while PAMP bars showcase the PAMP logo and Lady Fortuna’s image, which adorns most PAMP gold bars. Additionally, PAMP and Perth Mint 1-oz gold bars are sold in containers of 25, whereas Credit Suisse 1-oz gold bars are packaged in sheets of 10.

Perth Mint and PAMP one-ounce gold bars are readily available. Both come with twenty-five bars in a container., each individually encased. A container of twenty-five 1-oz gold bars measures 7-1/2″ X 4″ X 2-1/4″. By comparison, twenty-five 1-oz gold bullion coins in tubes would take up less than one-fifth of the space.

When choosing a reputable broker, you can expect bars sold by reputable mints with essential hallmarks— indicating weight, purity, and a serial number for easy verification, safeguarding your investment.

As the popularity of purchasing gold bars continues to rise, the risk of counterfeit products increases and 1-oz gold bar packaging becomes more challenging to visually detect as fraudulent.

Investors should be cautious when purchasing gold bars online from secondary sale sites like eBay. Timu and AliExress are known for selling high-end counterfeit bars. That’s why working with a reputable broker is more important than ever. Trusted firms employ state-of-the-art anti-counterfeiting technologies to ensure only authentic gold bars are offered, providing a sense of security and protection.

Investing in gold should be a rewarding experience, and a reputable broker makes all the difference. When you partner with CMI Gold & Silver, you will have peace of mind with 50 years of expertise and commitment to quality as we ensure that you are well-informed and confident about your purchase.

CMI Gold & Silver, with extensive experience in selling 1-oz gold bars since 1974, provides investors with a high level of expertise and confidence. We typically have 1-oz gold bars available at all times. Shipments are usually made within one to two days of receiving cleared funds. When you purchase from CMI Gold & Silver, you can be confident in the authenticity and delivery of your 1-oz gold bars, providing you with a sense of security. We are backed by over 50 years of experience providing quality products to investors nationwide.

Call one of our non-commissioned brokers today to get your questions about buying and selling precious metals answered.

Get investor insights delivered to your inbox! Sign up for our email to get the latest precious metals news, special alerts, and more.

Plus, be the first to get our articles of interest, newsletter, and specials.