There are different types of silver bars to consider that offer unique benefits for different investor preferences and needs.

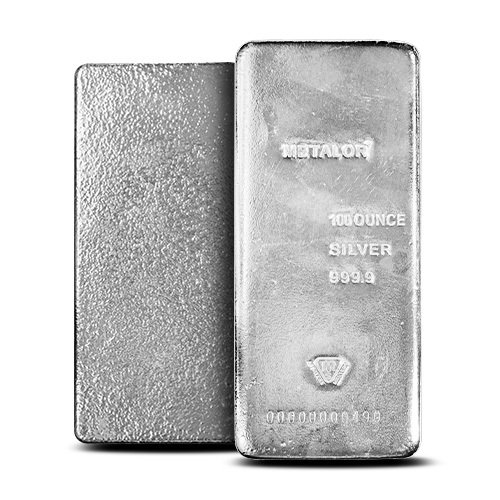

Cast Silver Bars: A cast silver bullion bar is created by pouring molten silver into open or closed molds. It has a rouged appearance with dimples and ripples and is less refined than minted bars. While the overall weight of the bar is consistent, each cast bar may have slight manufacturing variations. Cast bars typically come in larger sizes for investors looking for cost advantages. The 100-oz Canadian Royal Mint silver bar is an example of a cast bar.

Hand-poured Silver Bars: These bars are typically made for their craftsmanship and connection to traditional silversmith methods. They are made by hand-pouring molten silver into molds using a crucible. This labor-intensive process allows for unique artisan bars with rustic characteristics.

Minted Silver Bars: These bars are the opposite of cast bars. Precision manufacturing with a stamping princess achieves a polished finish. They have a standardized appearance, sometimes with detailed designs for those who prefer a refined look. Die-struck, stamped, and extruded are different types of minting processes.

Silver bars are uniform in shape, making them easy to stack and store. Most are 99.9% or .999 fine silver( three nines fine), meaning investors can store significant wealth in a smaller space. Some mints, like the Academy Mint, make specially designed linked bars for more stackable convenience.

Many investors like ten-ounce silver bars because they are easy to handle. Sunshine Mint and Asahi have made one-ounce silver bars readily available and affordable.

Silver bars are accepted trading units that are easy to buy and sell and are universally recognized bullion investments. 100-oz bars generally offer lower premiums over the spot price of silver compared to the smaller denominations of ounces. Buying a 100-oz bar is similar to purchasing silver in bulk, where you can acquire more for your investment. 1-oz silver bars appeal to investors who want greater flexibility when converting them back to cash. However, 1-oz rounds are preferred over 1-oz. bars.

Many well-established, trusted brands produce high-purity silver bars. The Royal Canadian Mint produces the most available 100-oz silver bars, the only bars with .9999 fine silver. Other manufacturers include Asahi (formerly Johnson Matthey), Sunshine Minting, PAMP Suisse, and Valcambi.

Many highly sought-after bars produced by reputable refineries, such as Wall Street Mint, Academy Mint, Engelhard, and Johnson Matthey (JM), are no longer in production. However, the JM 100-ounce bars, of which tens of thousands were made, are still widely available on the secondary market.

Other silver bullion bars bearing less known hallmarks are often available. Some of them are no longer minted but show up in the secondary market from time to time; others are currently being minted but have not yet gained popularity.

Did you know you can set up a precious metals IRA with eligible gold and silver bullion products? Gold or silver have proven to be a safeguard for wealth during times of economic downturns and uncertainty, so why not use this same power to safeguard your retirement savings? With a gold or silver IRA, investors own and control the invested bullion through the convenience of a custodial in the storage of a safe and secure IRS-approved depository. Similar to cash IRAs, the same tax implications apply to precious metal Traditional IRA and Roth IRA contributions. But, with precious metal IRAs, you receive the added benefit of the power of wealth preservation from gold and silver.

For more information about buying silver bars from CMI Gold & Silver Inc., see Doing Business with CMIGS. If you are interested in selling your silver bars (or silver bullion), visit selling gold and silver to CMIGS.

If you would like to discuss buying silver bars, call us at 1-855-425-6144. We take calls between 7:00 a.m. and 5:00 p.m. MST, Mondays through Thursday, Fridays 7:00 a.m to 3:00 p.m.

CMI has no minimum silver order. Silver bullion at discounted prices can often be found on our Silver Specials Page.

Get investor insights delivered to your inbox! Sign up for our email to get the latest precious metals news, special alerts, and more.

Plus, be the first to get our articles of interest, newsletter, and specials.