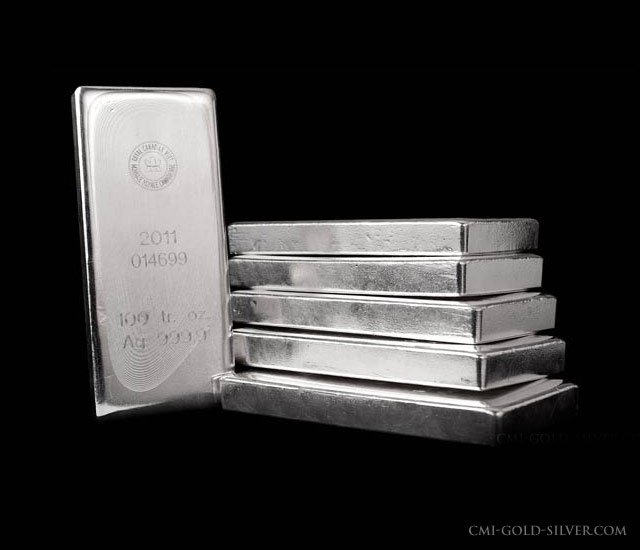

Investing in 100-oz silver bars can be a great choice for investors looking to diversify their portfolio quickly and on a large scale. They have many benefits, they are uniform in shape, easy to stack and store, and easy to handle, weighing only 6.86 pounds. A primary advantage is the cost-effectiveness of the bar since they typically have lower premiums than smaller silver products. This makes them an ideal option for those seeking to maximize holdings and minimize premiums.

999 fine 100-oz silver bars, usually stated as “three nines fine” silver bars, have been industry standards since the early 1970s. They maintain industry standards despite some manufacturers refining their silver to higher purities. Most 100-oz silver bars are .999 fine or 99.9% pure silver, which means investors can store an incredible amount of wealth in a relatively small space. However, the Royal Canadian Mint has produced .9999 fine or “four nines fine” silver bars, and Ohio Precious Metals produced .9995 (“three nines a five”) bars. There is minimal impact on investment value between .999 fine silver 100-oz bars and .9999 fine bars. Both are considered high-quality and commonly used in the bullion market. The main difference is that .9999 may incur a slightly higher premium because they are more refined. By industry standards, .999 is investment-grade silver and IRA-eligible and is more widely available.

In the early 1970s, inflation surged, prompting investors to seek protection by purchasing silver. Silver is one of the two reliable hedges against inflation, the other being gold. However, before January 1, 1975, it was illegal for investors to own gold bullion.

Small refiners began producing .999 fine silver products to meet the growing demand for silver. By the mid-1970s, demand had significantly increased, leading Engelhard, a prominent precious metals refiner, to start manufacturing. Engelhard’s 100-oz silver bars quickly became popular, and shortly afterward, Johnson Matthey, another esteemed precious metals refiner, began pouring 100-oz silver bullion bars.

By the mid-1980s, the Reagan administration had successfully reduced the inflation rate, resulting in a decline in silver purchases. Consequently, Engelhard and Johnson Matthey stopped producing silver bullion products.

Although Engelhard never resumed silver bar production, Johnson Matthey made a comeback in 2003 by reentering the silver bar market with its poured 100-oz silver bars. Tens of thousands of JM 100-oz silver bars were produced. It’s worth noting that JM has since sold its production facilities to Asahi, a global silver reclaimer.

100-oz silver bars are preferred for IRAs. However, CMIGS recommends 1,000-oz silver bars for larger IRA silver investments, which typically have smaller markups over spot prices than 100-oz silver bars.

IRA investors who anticipate taking physical delivery of the silver in their IRAs should opt for 100-oz silver bars despite their higher premiums than the 1,000-oz silver bars.

CMIGS advises against purchasing 1,000-oz silver bars for personal investments. Their weight often exceeds seventy pounds, making them costly to ship and difficult to handle.

Some investors include Silver Eagles in their IRAs, expecting to receive their silver later. Silver Eagles are the world’s most popular government-issued 1-oz silver coins. Others prefer 1-oz silver rounds for the same reason, as silver rounds generally carry lower premiums than Silver Eagles.

Because 100-oz bars are a popular option for investors, a wide variety of reputable refineries mint 100-oz bars.

The Royal Canadian Mint creates some of the most popular and readily available silver bars. Other notable brands include Asahi and Sunshine Minting. While reputable refineries like Engelhard and Johnson Matthey (purchased by Asahi) have stopped producing silver bars, many of their products can still be found on the secondary market due to the large quantities they manufacture.

Established in 1908, the Royal Canadian Mint (RCM) has become a trusted leader in precious metal refining. RCM is known for thier quality minting processes, innovation, and sustainability and has a long-standing reputation with precious metal investors. RCM manufactures the most sought-after silver bars on the market. Their most popular product is the 100-oz bar, simply called RMC 100s. These bars are uniform in size, the only .9999 fine 100-oz bar, and are serial numbered for added security.

Founded in 1817 by Percival Norton Johnson, Johnson Matthey(JM) became an esteemed household name in the precious metals industry for over two centuries. The company’s long-standing reputation for excellence is seen in every bar they produced, including their simple yet elegant popular 100-oz bar. While the company sold its gold and silver refineries to Asahi, the original silver bars produced before 2014 can be found on the secondary market, which adds a little historical significance to the bar. Additionally, they have not created stuck bars since the late 1980s, making them more scarce since not many were produced. Older JM-poured 100-oz silver bars are serial numbered, and the newly minted ones do not have a serial number.

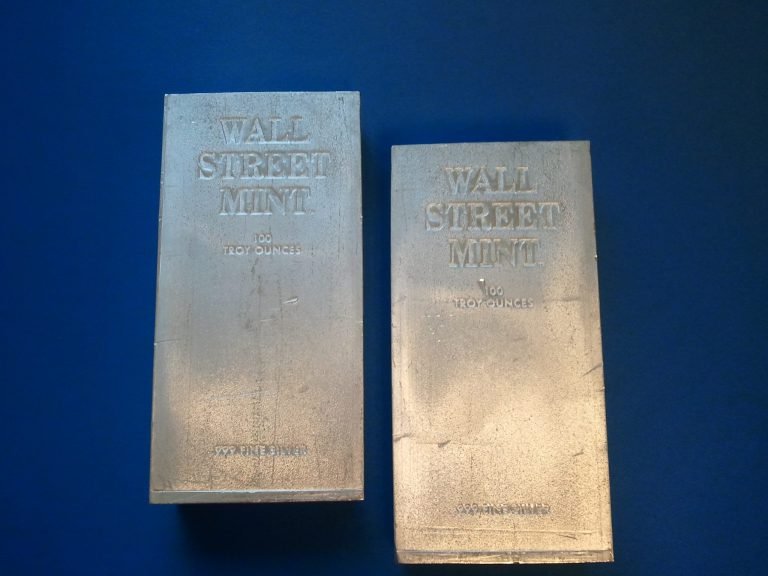

Wall Street Mint was founded after the 9/11 attacks and became a prominent name in the silver bullion industry. They gained popularity for producing 10-oz silver bars featuring designs of the New York City skyline, including the still-standing Twin Towers and Wall Street-themed imagery. In 2011, it was acquired by another mint, but the original silver bars occasionally appear on the secondary market, usually in pristine condition.

Wall Street Mint 100-oz silver bars are manufactured using an extrusion process and have the exact dimensions as extruded Engelhard silver bars. Wall Street Mint and Engelhard extruded 100-ounce silver bars are perfect for stacking and can be securely stored in safe deposit boxes.

The name Sunshine is nearly synonymous with silver because of the famed Sunshine Mine in the equally famed Coeur d’Alene Mining District, near Kellogg, Idaho. The Sunshine Company is now headquartered in Nevada. Sunshine Minting, Inc. (SMI) has become a leading manufacturer of precious metal products since 1979. The company has become the world’s largest silver supplier to the minting industry, including the US Mint, which uses SMI 1-oz blanks to produce Silver Eagles.

Investors can buy Sunshine Silver bars with confidence that they are purchasing a renowned name in the silver industry. Old Sunshine silver bars can be either struck or extruded. New Sunshine silver bars are struck. Most Sunshine silver bars are serial numbered.

Englehard, once a titan in the precious metals industry, has left a lasting mark on the world of silver bullion. Founded by Charles W. Engelhard Sr. in 1902 in Newark, New Jersey, the company quickly became the leading refiner and fabricator of precious metals, including platinum. Although it has not manufactured bars since the late 1980s, Englehard gained a reputation for excellence among investors, and their bars are still highly sought after.

Most Engelhard 100-oz silver bars are extruded (about 20% are hand-poured) and ideal for storage in safe deposit boxes. All extruded Engelhard silver bars measure the same; hand-poured Engelhard silver bars are rare and can vary slightly in dimensions. Most bars feature the Engelhard name, mintmark, inscription, weight, and purity mark.

Academy Corporation is a lesser-known but interesting refiner in the precious metals industry. Founded in 1990 in Albuquerque, New Mexico, they focused on smelting and refining operations. The company had a short-lived production, and their bars have become a niche in the vintage silver market. Academy bars created a sensation when they hit the market due to their production using CNC (computer numerical controlled) machine tools. This new technology created precision-cut silver bars identical in size and shape. They were the first bars to be manufactured using this state-of-the-art technology. Additionally, Academy designed a revolutionary bar with interlocking grooves, allowing the bars to stack efficiently like Lego pieces. When these bars become available on the secondary market, they are sold quickly because of their unusual form and function.

CMI Gold & Silver, with extensive experience in selling 100-oz silver bars since 1974, provides investors with a high level of expertise and confidence. We typically have 100-oz silver bars available at all times. Shipments are usually made within one to two days of receiving cleared funds. When you purchase from CMI Gold & Silver, you can be confident in the authenticity and delivery of your 100-oz silver bars, providing you with a sense of security. We are backed by over 50 years of experience providing quality products to investors nationwide.

Call one of our non-commissioned brokers today to get your questions about buying and selling precious metals answered.

Get investor insights delivered to your inbox! Sign up for our email to get the latest precious metals news, special alerts, and more.

Plus, be the first to get our articles of interest, newsletter, and specials.