While most Americans are familiar with traditional gold products, such as one-ounce or fractional sizes, small metric-weight gold bars are gaining traction. Their smaller unit weights and lower premiums, compared to fractional-ounce gold coins, make them an attractive investment option. These bars, minted by renowned refineries like The Perth Mint and PAMP, inspire confidence in the quality and value of the investment.

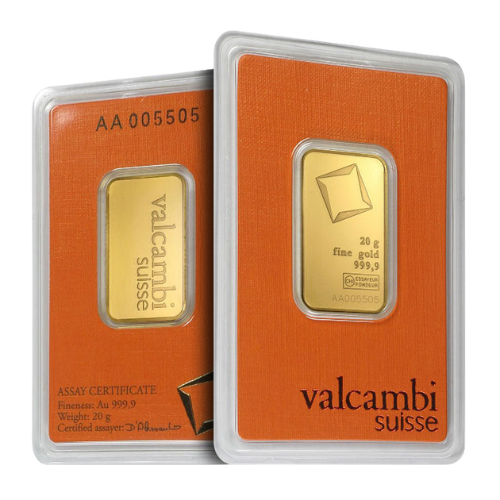

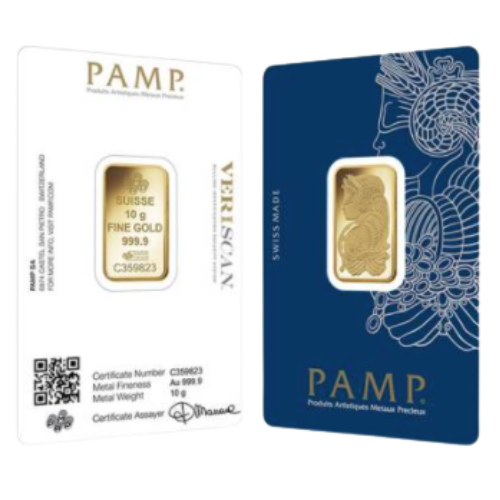

These small metric-weight gold bars, each .9999 pure and individually packaged, offer a range of sizes to suit your investment needs. The accompanying photos illustrate the variety available, empowering you with choice.

100-gram (3.215 oz) gold bars are the most popular metric option, with premiums varying from 4.5% to 1.7% based on the quantity purchased. In contrast, 1-ounce Gold Eagles have premiums ranging from 6.2% to 4.5%. Both Perth Mint and PAMP offer 100-gram gold bars that are widely available.

A twenty-gram gold bar contains approximately two-thirds of an ounce of gold, precisely 0.643 ounces. The premiums for 20-gram gold bars range from 3% to 7.1%. Perth Mint 20-gram gold bars are widely available and are packaged in sets of 25 bars per box.

A ten-gram gold bar is one-tenth the size of the popular 100-gram gold bar and contains 0.3215 ounces of gold. The premiums for ten-gram gold bars vary, ranging from 8.9% for small orders to 4% for larger orders. Perth Mint ten-gram gold bars are readily available and are packaged in boxes containing 25 bars.

CMI Gold & Silver Inc. offers five-gram gold bars, the smallest metric gold bars in its collection. Each 5-gram bar contains 0.1607 ounces of gold and has a premium of 10% to 5.5%. In comparison, the U.S. Mint’s 1/10-ounce Gold Eagles have premiums that range from 18% to 13%.

Perth Mint 5-gram gold bars are widely available and come packaged in boxes containing 25 bars each.

The concept of premiums is crucial in the gold market. Smaller pieces of gold often carry higher premiums than larger ones. For instance, American Gold Eagles are available in four different weights: 1 ounce (oz), ½ ounce, ¼ ounces, and 1/10 ounce. The 1/10 oz Gold Eagles, being the smallest, has the highest premiums, while the 1 oz Gold Eagles, the largest, have the lowest. The ½ oz and ¼ oz coins fall between these two extremes.

Additionally, government-minted “legal tender gold coins” typically command higher premiums than privately minted gold products of comparable weights. Legal tender gold coins usually command higher premiums when compared to products from the same mint. For instance, 1 oz Australian Kangaroo coins from the Perth Mint command higher premiums than 1 oz gold bars produced by the same mint.

Small metric gold bars are an excellent choice for those looking for a more cost-effective option than high-premium fractional-ounce legal tender gold coins. Their significantly lower premiums make them a prudent and reassuring investment for those seeking to maximize their returns.

Contact one of our non-commissioned brokers today to get all your questions about gold bars answered and determine the best solution to suit your investment needs.

CMI Gold & Silver, with extensive experience in selling small gold bars since 1974, provides investors with a high level of expertise and confidence. We typically have small gold bars available at all times. Shipments are usually made within one to two days of receiving cleared funds. When you purchase from CMI Gold & Silver, you can be confident in the authenticity and delivery of your small gold bars, providing you with a sense of security. We are backed by over 50 years of experience providing quality products to investors nationwide.

Call one of our non-commissioned brokers today to get your questions about buying and selling precious metals answered.

Get investor insights delivered to your inbox! Sign up for our email to get the latest precious metals news, special alerts, and more.

Plus, be the first to get our articles of interest, newsletter, and specials.