Paul Revere’s story offers a fascinating parallel for today’s precious metals investors. Most people know him for his midnight ride, but fewer realize that before he became America’s most famous messenger, he was one of Boston’s most skilled silversmiths.

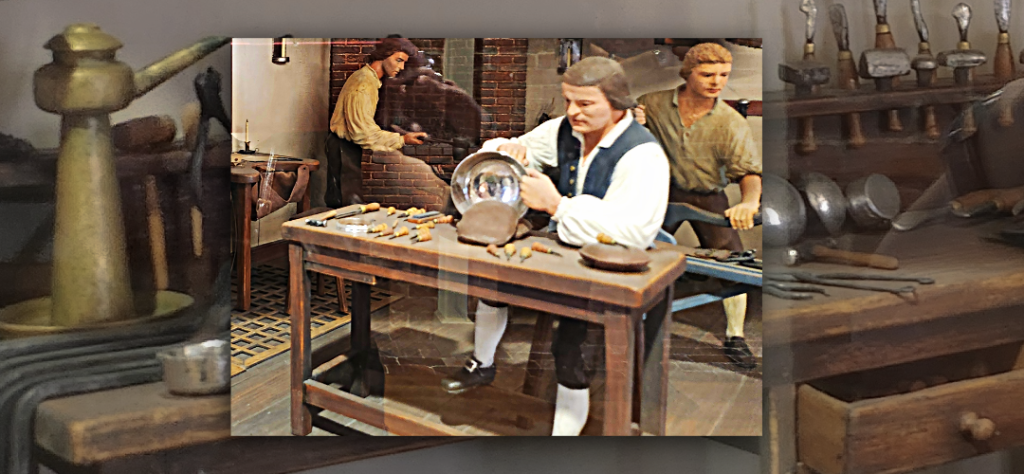

The Craftsman’s Foundation

Revere’s silver shop was the cornerstone of his professional life. From 1761 to 1797, his detailed business ledgers show he created over 5,000 silver objects – not just elaborate tea services for the wealthy, but practical items like buckles, buttons, and spoons for everyday Americans. His shop served customers of all economic levels, understanding that silver’s value wasn’t just for the affluent.

What made Revere exceptional wasn’t just his craftsmanship – it was his awareness. As a silversmith, he understood precious metals’ intrinsic value. As a patriot, he stayed informed about the political and economic currents that could affect his community and

livelihood.

The Informed Observer

Revere didn’t ride through the night shouting, “The sky is falling!” Instead, he delivered specific, actionable intelligence: “The regulars are coming out.” He had been watching, listening, and preparing. His network of fellow patriots kept him informed about

British movements not through panic, but through careful observation.

Today’s precious metals investors can learn from Revere’s approach. Rather than reacting to every market headline with alarm, successful investors stay informed about the fundamental factors that drive precious metals values – inflation trends, currency policies, and global economic shifts.

The Prepared Professional

Revere’s midnight ride succeeded because he had prepared for years. He knew the routes, established signal systems, and built relationships with other patriots. When the moment came for action, he was ready.

Similarly, smart precious metals investors don’t wait for a crisis to strike before considering portfolio diversification. They study market patterns, understand their investment goals, and make measured decisions based on long-term wealth preservation strategies.

The Enduring Value

After the Revolution, Revere returned to his silver shop, which continued operating into the early 1800s. His silver pieces remain valuable today – not because of panic or fear, but because of their intrinsic worth and craftsmanship.

Like Revere’s silver, precious metals have maintained their value across centuries of economic change. They’re not a panic purchase but a thoughtful addition to a diversified portfolio.

Modern-Day Vigilance

Paul Revere teaches us that true preparedness comes from staying informed, not from fear. At CMI Gold & Silver, we believe in providing you with clear, honest information about precious metals markets – no midnight alarms, just the facts you need to make informed decisions to prepare for the future.

Whether you’re just beginning to explore precious metals or looking to expand your holdings, we’re here to help you navigate these decisions with the same careful consideration Revere brought to his craft.

Johnny on the Spot: A transparent article series by Johnny Estes, VP of CMI Gold & Silver. Get honest insights on current events shaping the precious metals market, free from fear-mongering, to help you make informed investment decisions.

Have a precious metals topic you would like us to explore? Comment below!